Let’s talk about something every homeowner needs to plan for, but few actually do: the cost of home maintenance. Your monthly mortgage payment? That’s just the beginning. Between replacing worn-out appliances, fixing leaky roofs, and keeping your HVAC system running, you’re looking at thousands of dollars each year. Many first-time buyers don’t see it coming until their water heater fails at the worst possible time.

So why are these expenses climbing higher each year? And more importantly, how much should you actually be setting aside? We’ll break down both questions so you can protect your wallet and your home.

House maintenance costs aren’t just creeping up; they are jumping each year significantly. Economic and environmental pressures, along with hidden costs, are colliding to create this expensive reality for homeowners nationwide. Let’s see what these are:

Contractor rates have increased as skilled labor remains in short supply. At the same time, the cost of materials like lumber, wiring, and HVAC components has gone up. Even smaller repairs now carry higher price tags because service providers must account for wages, insurance, and operating costs.

Most American homes are decades old, with the median age hovering around 40 years. Older homes need more frequent repairs as original systems reach the end of their lifespan. As more homes hit these critical age milestones simultaneously, repair costs climb automatically. Plus, bringing older systems up to current building codes adds extra expense to any major repair.

Climate change has intensified weather patterns, leading to more damage and stress on house systems. Extended heat waves, heavy storms, and unpredictable seasons increase demand for repairs, especially for HVAC and roofing. This demand drives up service costs year after year.

Many buyers don’t fully account for maintenance costs in their budgets. According to the Bankrate 2025 Homeowner Regrets Survey, 42% of homeowners with regrets said maintenance and hidden costs were higher than expected. It was the most commonly reported reason for frustration tied to homeownership.

In states with high upkeep costs, like California, homeowners look for smart solutions, such as buying a California home warranty. It covers unpredictable repairs of critical systems and appliances at an affordable monthly or yearly plan. From scheduling a technician to covering expenses, everything is managed by your warranty provider.

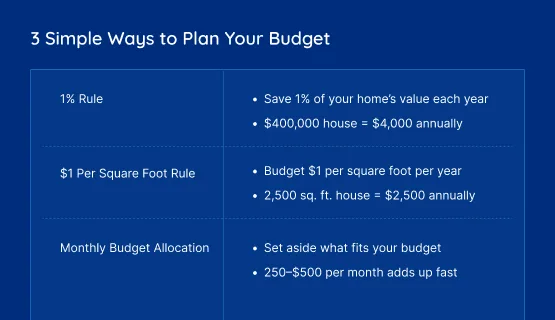

There is no universal answer, but several proven methods can help you calculate a realistic savings target. Choose the approach that aligns best with your financial situation and your home’s specific needs.

This popular method suggests setting aside 1% of your home’s value each year for maintenance and repairs. Own a $400,000 home? Then, plan to set aside $4,000 each year. Some experts recommend stretching this to 2-4% for older properties or homes with aging systems.

This rule accounts for your home’s market value, making it more comprehensive than other methods. However, it doesn’t consider factors like local labor costs or climate conditions that might increase your actual expenses.

Under this approach, you budget $1 for every square foot of living space. A 2,500-square-foot house would need $2,500 saved annually. This method is straightforward and easy to calculate, but it has limitations. It doesn’t factor in your home’s age, condition, or the quality of its systems. A brand-new 2,000-square-foot house requires less maintenance than a 30-year-old house of the same size, yet this rule treats them identically.

Rather than calculating based on house value or size, this strategy focuses on what you can actually afford. Pick a realistic monthly amount, maybe $250, $500, or whatever fits your budget, and automate transfers to a dedicated savings account.

Align deposits with your payday so the money moves immediately. Even if this doesn’t equal 1% of your home’s value, consistent saving beats saving nothing. You’re building a cushion for inevitable repairs instead of scrambling for cash during emergencies. There is no denying that the cost of home maintenance hits hardest when you’re unprepared financially.

Want deeper strategies for handling surprise repairs? Read more about how to budget for repairs in our blog: Budgeting for Unexpected Home Repairs: A Practical Guide.

A NAHB report on home operating expenses reveals an important pattern. About 10.8% of total ownership costs go toward regular maintenance and routine repairs. That works out to roughly 0.54% of a home’s overall value each year.

Older single-family homes, especially those built before 2010, tend to be more expensive to maintain. On average, homeowners spend around 5% of the home’s value, or about $9,240, on upkeep. Newer homes built after 2010 cost less to maintain at roughly 3%, but they come with a much higher purchase price. The typical new U.S. house spans 2,600 square feet and costs $423,800, compared to $184,800 for older homes.

Put it all together, and most homeowners end up spending between $1,400 and $2,300 annually on routine maintenance. And that’s before factoring in surprise repairs or major replacements that can hit without warning.

No matter your home’s size, age, or location, there are dozens of routine tasks that need attention each year. These include:

Heating, venting, and air conditioning (HVAC)

When you break it all down, home maintenance includes well over 100 inspections, cleaning, and repairs. Some are simple DIY jobs, while others are best handled by professionals, scheduled throughout the year to keep your house running smoothly.

Skipping routine upkeep often leads to larger repairs. Tasks like filter changes, seasonal HVAC checks, and gutter cleaning help systems last longer. These jobs usually cost far less than replacements. Following a simple annual schedule also helps spot early warning signs before they become expensive problems. Consistency plays a big role in keeping yearly expenses under control.

Many homeowners forget about manufacturer warranties. Appliances, water heaters, and even roofing materials may still be covered. Before scheduling a repair, check the paperwork or the manufacturer’s websites. Using warranties when available can save hundreds and extend the lifespan of your home’s essentials.

A large share of home upkeep expenses goes for the three critical systems, like HVAC, plumbing, and electrical. Everyday appliances, such as refrigerators, ovens, washers, and dryers, also add to repair expenses.

With a home warranty plan, you pay a monthly or annual premium that’s far lower than most repair bills. When a covered system or appliance breaks down, you pay only a service fee, typically $65 to $75. Without coverage, similar repairs can easily run into the thousands.

The most expensive home maintenance tasks often include professional house cleaning, roof repairs, and tree trimming or removal. Ongoing services like lawn care, window cleaning, water heater maintenance, and gutter cleaning also add up over a year, especially when handled by professionals.

Home upkeep spending usually rises during seasonal transitions, especially in spring and fall. These periods often bring HVAC servicing, yard work, and weather-related repairs that stack up within a short time.

Yes, energy-efficient appliances can help lower maintenance costs over time. They’re built to run with less strain, which often means fewer repairs and longer lifespans. You may also see savings on utility bills, which helps balance the cost of home maintenance per year.

Disclaimer: The information in this article is intended to provide guidance on the proper maintenance and care of systems and appliances in the home. Not all the topics mentioned are covered by our home warranty plans. Please review your home warranty contract carefully to understand your coverage.

Our blogs and articles may link to third-party sites that offer products, services, coaches, consultants, and/or experts. Any such link is provided for reference only and not intended as an endorsement or statement that the information provided by the other party is accurate. We are not compensated for any products or services purchased from these third-party links

Don’t wait until it’s too late! Check out our current plans and get your free quote.

Household Tips

Sump pumps are the key to setting your home up for success when it comes to water entering the home. This simple mechanism could mean all the difference between saving..

Household Tips

Your thermostat acts as the “brain” of your HVAC system, monitoring temperatures and communicating when to heat or cool your house. As a result, a failing thermostat can quickly lead..

Home Warranty

When we consider the happiness of our homes, no one wants to worry about sudden accidents. The best home warranty will cover your most important appliances and systems so you..