Arizona homes do more than shelter you. They battle dust storms, dry heat, and nonstop wear and tear. And when your refrigerator quits mid-summer or your plumbing gives up after monsoon season, panic sets in. Arizona home warranty plans are designed to take that panic out of the picture.

But are you picking the right one? That’s where most homeowners hit a wall. Too many options. Too much jargon. And somehow, you are still stuck wondering what’s actually covered.

Attractive coverage lists and low monthly rates might grab your attention. But what really matters is how fast you get service and whether that ‘included’ repair ends up costing you extra.

Let’s sort through the noise.

This guide is your no-fluff roadmap to choosing a warranty plan that actually works when you need it and doesn’t leave you sweating over the fine print.

Choosing an Arizona home warranty plan offers solid peace of mind, but only if you know exactly how much financial relief to expect.. Before locking in your coverage, it’s worth spending a few minutes reviewing the plan details carefully.

It helps you feel confident and prepared with no surprises later. You know what the plan actually delivers and can make the most of your investment.

Before signing anything, take a good look at the contract. You are allowed to read it ahead of time, and you should. Warranty coverage always comes with limits and exceptions.

For example, your air conditioning might be included, but certain internal parts could be listed separately. Plumbing plans might not cover every clog or leak either. A quick review helps you get the full picture.

While both protect your home in different ways, a home warranty is a service contract that covers the repair costs of wear and tear on home systems and appliances if a breakdown happens. It works differently from homeowners’ insurance when it comes to claims. However, you may hear words like “deductible,” but home warranties are not the same as an insurance policy.

Every time you request a repair for a covered item, a service fee applies. This is the cost for a technician to inspect the issue and determine the next steps, and it typically falls somewhere between $75 and $100. The fee also depends on the contract length.

Warranty providers typically use their own network of service contractors. This means you won’t be choosing who comes out to handle the repair, as they’ll send someone from their pre-approved list. This can save you time and eliminate the stress of searching for a reliable technician.

Most plans include dollar limits per item or repair. If the total repair cost exceeds that limit, you may need to pay the difference. This helps keep monthly premiums affordable while still offering meaningful support whenever any system or appliance stops working.

Like any contract, home warranties come with guidelines. If you have had unauthorized work done or changed a system, it could affect your coverage. Following the claims process and guidelines ensures fair service for everyone.

Before you count on a warranty to cover your next repair, it helps to know exactly what you are signing up for. Not everything is covered, and not all warranty plans operate the same way.

Let’s walk through the basics so that you can save yourself time, money, and a lot of frustration later.

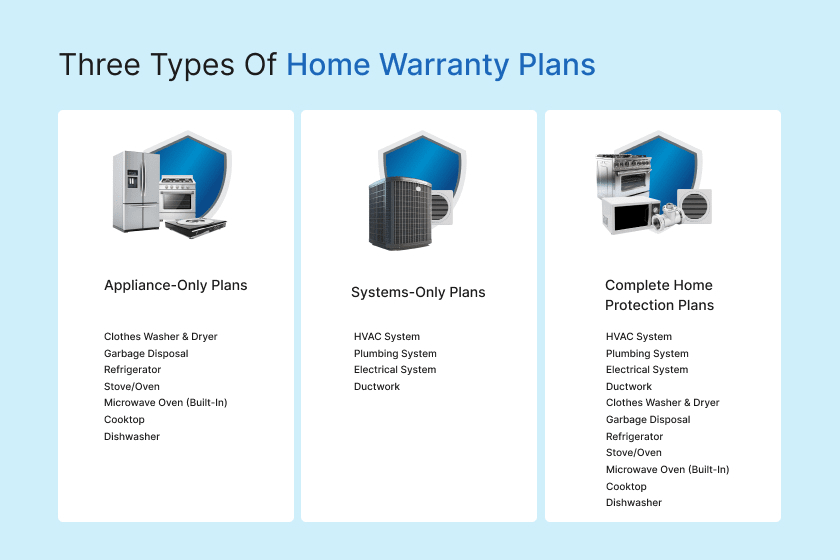

Before you choose a plan, it makes sense to know what kind of coverage fits your home best. Most plans fall into three categories, each with a different focus, depending on what you want to protect.

Appliance-Only Plans

This option covers your household appliances such as refrigerators, stoves, garbage disposal, dishwashers, and dryers. It’s usually the most affordable tier and ideal if your main concern is keeping the kitchen and laundry room up and running.

Systems-Only Plans

Here, the focus is on major systems: plumbing, electrical, and HVAC systems. These plans are great if you are more worried about those high-dollar repairs that tend to sneak up when you least expect them.

Combination or Complete Home Protection Plans

This plan offers the maximum coverage for home essentials. It includes everything from appliances to systems, all in one bundle. It costs more but gives you a broader safety net for your home.

Most standard plans offer coverage for a range of essential appliances and systems. Below is a list of items that are commonly included in Arizona home warranty plans:

Coverage may vary slightly by provider, but these are usually the core items protected under most plans.

Home warranties are helpful, but they don’t cover everything. It’s just as important to understand what’s excluded as to know what’s included. Here’s a breakdown of limitations and items that are typically not covered:

There is no universal rule on when to get home warranties, but there are several situations where it makes a lot of sense. The few instances when it’s absolutely beneficial to buy a warranty are:

Just closed on your new home? A warranty can help cover repairs while you are still learning the ropes. If anything goes wrong early on, you are not stuck paying out of pocket on top of moving expenses or renovations.

Offering a warranty as part of your sale can help attract more buyers. It gives potential homeowners extra confidence knowing they’ll have repair coverage for the first year. It can also help reduce post-sale disputes if something breaks shortly after the deal closes.

It’s no surprise that older appliances tend to act up. If your washer or dryer has been around for a while, chances are it might give you trouble sooner than you think. The same goes for your other systems or appliances, like your microwave, dishwasher, or even your HVAC system.

These things work hard day after day, so it’s only natural that they start showing signs of wear. And when they do, repairs aren’t just likely, they are often needed.

Being a homeowner often feels like there’s always another expense waiting around the corner. But with a home warranty in place for your Arizona property, you won’t be stuck footing the full bill when something breaks. Instead of draining your savings on surprise repairs, you can keep that money for the things you actually want to spend it on.

Owning a rental in Arizona comes with its share of wear and tear, especially when tenants don’t treat it quite like you would. Home warranties for rental properties give you backup when things go wrong. Instead of searching for a repair service last-minute, you’ll have access to a vetted network of pros to handle the issue quickly and keep your property running smoothly.

Choosing a warranty company isn’t just about finding the lowest price. It’s about finding a team you can count on when things go sideways. Here’s how to make sure you are picking one that has got your back.

Protecting your home shouldn’t feel like a chore or a financial stretch. Select Home Warranty offers solid coverage plans for every type of homeowner, from kitchen and laundry appliances to full-system protection.

We put your home and your time first. Our goal? Make unexpected breakdowns less overwhelming. With fast-tracked claims, round-the-clock support, and transparent pricing, you get the protection you need without the runaround.

Whether you are a new homeowner, a busy landlord, or a realtor managing listings, it doesn’t matter. We have flexible Arizona home warranty plans built to match your pace, your property, and your budget.

Though a home warranty isn’t mandatory in Arizona, it can be a smart safety net. It helps cover the cost of repairs or replacements when covered appliances or systems break down. It saves you from large, unexpected expenses and gives your budget some breathing room.

The price depends on a few key factors like your home’s size, the plan and level of coverage you pick, and the service fee you choose at signup. Adding extra items to your base plan can also affect the overall cost.

Select Home Warranty is a top choice for Arizona homeowners seeking reliable and affordable coverage. With flexible plans and fast, 24/7 claims support, they make home protection simple and stress-free.

Disclaimer: The information in this article is intended to provide guidance on the proper maintenance and care of systems and appliances in the home. Not all the topics mentioned are covered by our home warranty plans. Please review your home warranty contract carefully to understand your coverage.

Our blogs and articles may link to third-party sites that offer products, services, coaches, consultants, and/or experts. Any such link is provided for reference only and not intended as an endorsement or statement that the information provided by the other party is accurate. We are not compensated for any products or services purchased from these third-party links

Don’t wait until it’s too late! Check out our current plans and get your free quote.

Household Tips

When it comes to keeping our homes safe, it’s important to keep the locks functional and unique. Changing or rekeying the locks on your home may be routine or required...

Home Warranty

Home warranty exclusions and coverage limits can vary when comparing home warranty companies. That said, most omissions are pretty standard. Here are the most common exclusions to remember when buying..

Household Tips

If you’ve never had a garbage disposal before, you’re in for a treat. Garbage disposals are an incredible appliance, reducing the amount of biodegradable food waste that winds up in..