Closing day can feel like the finish line. Until the final numbers land in front of you. Many buyers pause at that moment and wonder, “What are prepaid costs when buying a home?” and why do they show up before the first mortgage bill? These expenses are advance payments for expenses that kick in as soon as you take ownership.

This guide breaks down which prepaid costs are most common, how they’re different from closing costs, and why they exist in the first place. You’ll also get to know about some simple ways to calculate them early, so your numbers stay realistic.

Prepaid costs are expenses you pay at closing for bills that will come due shortly after you become a homeowner. They aren’t fees for the loan itself. Instead, they cover items like property taxes, homeowners’ insurance, and daily mortgage interest that starts accruing right away.

Even though these costs are paid upfront, they’re meant for future use. The funds are typically placed into an escrow account and used when the actual bills are due. This helps ensure there’s no gap in coverage or missed payments during the early days of ownership.

Prepaid costs aren’t one flat charge; they’re a mix of a few key items that depend on your loan, location, and timing. The amount can change based on local taxes, insurance requirements, and even the day you finalize the purchase. Below are the most common prepaid expenses you’ll see at settlement.

Most lenders require you to pay six months to one year of homeowners’ insurance upfront. This ensures your property has coverage from day one, protecting both you and the lender’s investment. The payment can be made directly to the insurer or handled through escrow.

After the first year, premiums are usually included in your monthly mortgage payment. You can check our comparative study on homeowners’ insurance vs home warranty to understand how they differ.

This covers the interest that accumulates between your closing date and your first mortgage payment. Since most payments are due on the first of the month, you’ll prepay interest for any remaining days in your closing month.

For example, closing on the 15th means prepaying about 15–16 days of interest. The amount is based on your loan and rate, multiplied by the days left. Want to reduce this cost? Schedule your closing near the end of the month to minimize the days of prepaid interest you owe.

Property taxes are prepaid to cover the period from your closing date through the end of the year or the next tax due date. According to the IRS, property taxes may be deductible, but they still have to be paid up front. Lenders typically collect two to six months of taxes in advance and deposit the funds into your escrow account.

The exact amount depends on local tax rates and when the transaction is finalized. Buying earlier in the year usually means prepaying for more months. Once taxes are due, your lender pays the tax authority directly from escrow.

Some lenders require an additional escrow deposit at closing to create a buffer in your escrow account. This cushion ensures there’s always enough money available when your insurance or tax bills arrive.

Not all lenders require this, but it’s common with conventional mortgages. This money stays in your escrow account and gets used for future payments, so you’re not losing it, just paying it earlier than the bill’s due date.

Easy hacks to lower your prepaid escrow deposit:

Lenders require prepaid expenses to make sure essential homeownership bills are covered from day one. These upfront payments fund your escrow account early, helping manage costs that begin before your first mortgage payment is due.

If you’re trying to understand “What are prepaid costs when buying a home?” before you reach closing day, a little math goes a long way. Below is a simple way to estimate the most common prepaid costs so you know approximately what to expect.

A rough way to calculate annual homeowners’ insurance is to budget about 0.4% of the home’s price.

For a $420,000 home: $420,000 × 0.004 = $1,680 per year

For the monthly premium: $1,680 ÷ 12 = $140

If your lender requires 12 months of prepaid: $140 × 12 = $1,680 prepaid at closing

Keep in mind that actual premiums depend on your coverage level, deductible, and location. Homes in flood zones or wildfire areas will cost more to insure. Get quotes from multiple insurers for a precise number.

For instance, California homeowners face some of the nation’s highest insurance premiums due to wildfire and earthquake risk. So, many homeowners rely on a California home warranty to offset these high upfront costs with predictable post-purchase protection.

Look up your county’s property tax rate online; most county assessor websites list this information.

For a $425,000 home with a 1.5% tax rate: $425,000 × 0.015 = $6,375 annually

Monthly escrow amount: $6,375 ÷ 12 = $531.25

If you close in August with four months left in the year: $531.25 × 4 = $2,125 prepaid at closing

Your lender holds these funds in escrow and pays your local tax authority when bills come due. The prepaid amount changes based on your settlement month. If you close in February, you’ll prepay more than if you close in November.

Your closing date directly impacts how much interest you’ll prepay. Here’s how to calculate it.

First, find your daily interest charge: (Annual rate ÷ 365) × Loan amount

For a $340,000 loan at 6.5%: (0.065 ÷ 365) × $340,000 = $60.55 per day

Closing on the 8th with 22 days remaining: $60.55 × 22 = $1,332.10 prepaid

Closing on the 27th with just 3 days left: $60.55 × 3 = $181.65 prepaid

That’s over $1,150 in savings just by scheduling your closing strategically. This is one of the easiest ways to reduce your upfront costs at closing.

If your loan requires mortgage insurance, part of it may be due upfront.

FHA loans

If you’re getting an FHA loan, the upfront mortgage insurance premium is 1.75% of your loan amount. For a $340,000 loan: $340,000 × 0.0175 = $5,950 due at closing.

Conventional loans with PMI

For conventional loans requiring private mortgage insurance (PMI), expect to pay around 0.6%–1.2% of your loan amount annually. On a $340,000 loan at 0.8% annually: $340,000 × 0.008 = $2,720 per year, or $226.67 monthly. You’ll typically prepay two months: $226.67 × 2 = $453.34.

Exact amounts depend on credit score, down payment, and loan type.

Estimates are for planning purposes only. Always review your Loan Estimate and Closing Disclosure for final numbers based on your specific loan terms.

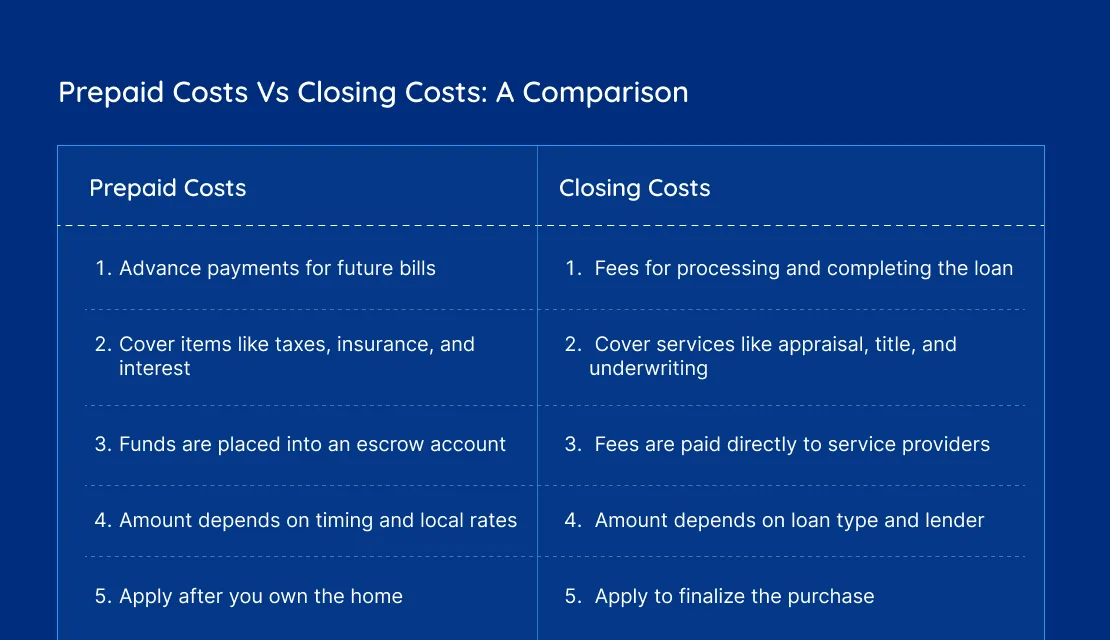

Both prepayment and closing costs are paid at settlement, but they serve very different purposes. The former covers future homeownership bills, while the latter, also known as hidden costs, pays for the loan and transaction itself.

This distinction helps explain why prepaid expenditures feel upfront, even though they pay for expenses you haven’t incurred yet.

Buying a home is exciting, but those upfront numbers can feel confusing if you’re not prepared. Once you understand prepaid costs when buying a home, they stop feeling like surprise fees and start making sense as part of the bigger picture. These costs are simply early payments that keep your home protected and your loan on track from day one.

As you review your estimates and move toward closing, staying aligned with your lender or agent makes a big difference. This is also a good time to think beyond closing day, options like how a home warranty company can help cover unexpected repair costs after you move in, adding another layer of financial predictability. With the right preparation, you can step into your new home feeling informed, protected, and confident.

Disclaimer: The information in this article is intended to provide guidance on the proper maintenance and care of systems and appliances in the home. Not all the topics mentioned are covered by our home warranty plans. Please review your home warranty contract carefully to understand your coverage.

Our blogs and articles may link to third-party sites that offer products, services, coaches, consultants, and/or experts. Any such link is provided for reference only and not intended as an endorsement or statement that the information provided by the other party is accurate. We are not compensated for any products or services purchased from these third-party links.

Don’t wait until it’s too late! Check out our current plans and get your free quote.

Home Warranty

If you’re shopping for a home warranty for the first time, it might feel like there’s a lot to take in. Even for those among us who have owned multiple..

Household Tips

When it comes to saving money on your gas or electric bill, few things are more effective than these recommended thermostat settings. Some homes have multiple thermostats in multiple zones,..

Home Warranty

When you purchase a home warranty, it’s a unique agreement to care for your home’s appliance and system needs. While you can choose which parts of your home are covered..