Buying a house feels exciting. But once you move in, the monthly costs of owning a home become part of everyday life. We’re talking utilities, insurance, maintenance, and a whole lot more that can quietly add up. In fact, many homeowners are surprised when these “hidden” expenses start rolling in each month.

The truth is, your dream home comes with a realistic price tag that extends past closing day. Understanding what you’ll actually spend each month is crucial before you close on the home. Here, we’ll break down the typical monthly expenses you can expect as a homeowner and explore the key factors that influence these costs across the United States. Let’s make sure you’re financially prepared for everything homeownership brings your way.

Most people budget for their mortgage but forget about everything else. But your mortgage payment is just the beginning. Between taxes, insurance, and upkeep, homeownership brings a full lineup of recurring expenses that deserve your attention before you buy.

Let’s break down what actually shows up on your monthly bill as a homeowner.

Property taxes vary dramatically based on your location and home value. Some states keep rates low, while others can be surprisingly expensive. If you’re buying a $350,000 home, your monthly property tax could range from $90 to over $700. That’s a significant difference depending on where you choose to live. This cost is also known as prepaid costs when buying a home.

Most lenders bundle property taxes into your monthly mortgage payment through an escrow account. They collect it each month and pay your tax bill when it’s due. If you put down less than 20%, this arrangement is typically required.

Your lender won’t let you skip homeowners’ insurance, and you shouldn’t want to anyway. It covers fire damage, theft, and storm damage. Monthly premiums typically range from $85 to $290, but location matters enormously.

Living near the coast or in wildfire territory? Your rates could climb much higher. Some homeowners in high-risk areas are seeing their monthly premiums double or triple as insurance companies reassess climate-related risks. The age of your home, its construction type, and your chosen coverage level all play into what you’ll pay each month.

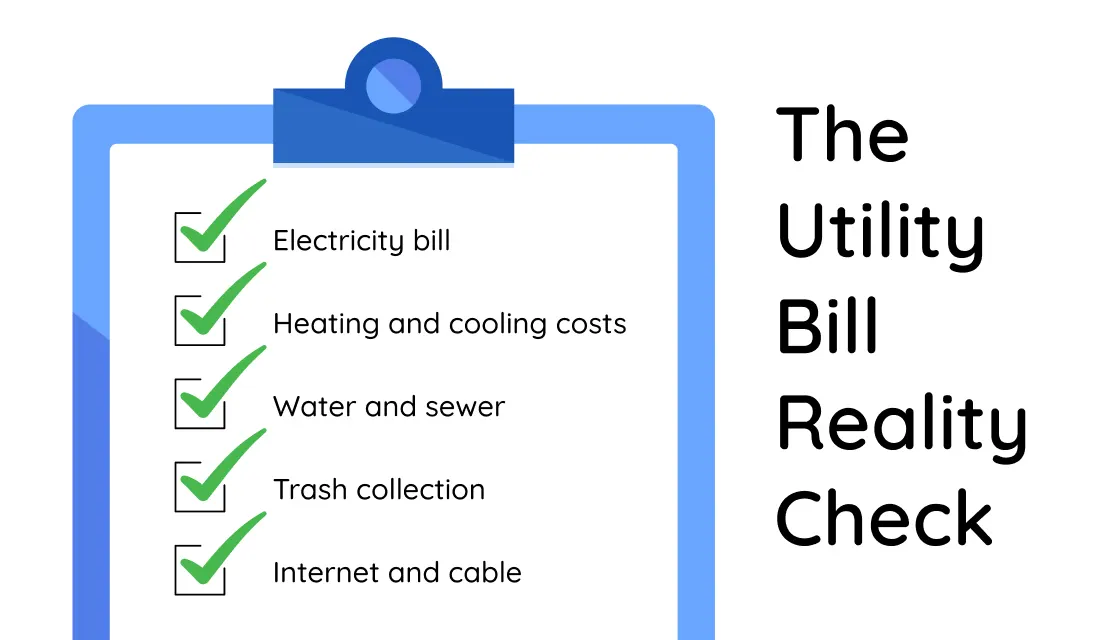

Renters often have utilities included or shared. Homeowners pay for everything separately, and these hidden costs can be a real eye-opener. Here’s what to expect monthly:

Energy-efficient homes save you money here, while older properties with single-pane windows and minimal insulation will cost you more.

Though a home warranty isn’t required by your lender, it can save you from massive unexpected repair bills. When your HVAC system dies or your refrigerator stops working, you pay a small service fee instead of the full replacement cost.

Monthly costs for home warranties typically range from $35 to $75, depending on your coverage level. Basic plans cover essential systems like heating, cooling, electrical, and plumbing. Comprehensive plans add major appliances like your washer, dryer, and dishwasher. The service fee depends on the plan you select, but most homeowners can expect it to range from $65 to $200 per claim.

You can’t call a landlord anymore when something breaks. Maintenance becomes your responsibility and your expense. Houses need constant attention. Lawns grow, HVAC filters get dirty, and things wear out. The monthly costs of owning a home include regular maintenance you simply can’t skip.

Apart from these, you need to set aside money each month for bigger repairs, too. Water heaters fail, roofs develop leaks, and appliances break down. Building a maintenance fund now prevents financial stress later. If you want a clearer picture of what to budget each year, take a look at our guide on the annual cost of home maintenance for a detailed breakdown.

Regional issues can create ongoing monthly expenses that most buyers don’t anticipate. Termites love certain climates and can cause thousands in damage if left unchecked. Annual inspections and treatments run $75–$1,500, depending on your area and whether you have an active infestation. If you convert these costs into monthly services, then these will come down to:

Not every home costs the same to maintain. The average cost of owning a home per month can swing dramatically based on several key factors that many buyers overlook during their home search. Let’s see what actually impacts your monthly expenses:

Age of Your Home

Older homes often need more frequent repairs and updates. A house built in the 1970s will likely have higher maintenance costs than new construction with modern systems and materials.

Current Condition

What the home inspection reveals matters significantly. Deferred maintenance issues mean you’ll be spending more in the near future to catch up on neglected repairs and replacements.

Geographic Location

Where you live affects contractor rates, material costs, and what kind of maintenance your home requires. Coastal homes face salt air corrosion, while desert properties deal with intense sun damage and dust.

Construction Quality

The materials used in your home directly impact long-term costs. Cheap vinyl siding needs replacement sooner than brick or fiber cement. Quality roofing materials last decades longer than budget options.

Climate Risks

Your local weather patterns determine specific expenses. Homes in snowy regions need roof reinforcement and snow removal. Properties in humid areas require mold prevention and extra HVAC maintenance to handle moisture.

Based on recent U.S. Census Bureau data, the median monthly costs of owning a home, adjusted for inflation, climbed to $2,035 in 2024, nearly a 4% increase from $1,960 in 2023. This figure includes mortgage payments, insurance premiums, property taxes, utilities, and related housing expenses.

The rise in overall homeownership costs has been largely driven by elevated mortgage interest rates, increasing fees, and higher insurance premiums. The data also revealed the following facts.

The monthly costs of owning a home don’t have to drain your finances. Smart planning and a few simple strategies can help you stay on top of these expenses without constant financial stress. Below are some tips to manage your homeownership expenses:

The average cost of owning a home per month might seem intimidating at first glance, but remember, millions of Americans manage these expenses successfully every year. The difference between struggling and thriving as a homeowner often comes down to preparation and realistic budgeting.

You now have a clear picture of what monthly homeownership actually costs, from the obvious expenses like insurance to the hidden ones like pest control and seasonal maintenance. Use this knowledge to your advantage. Calculate your true housing budget, build your emergency reserves, and choose a home that fits your financial reality. Smart planning today means confident homeownership tomorrow.

Disclaimer: The information in this article is intended to provide guidance on the proper maintenance and care of systems and appliances in the home. Not all the topics mentioned are covered by our home warranty plans. Please review your home warranty contract carefully to understand your coverage.

Our blogs and articles may link to third-party sites that offer products, services, coaches, consultants, and/or experts. Any such link is provided for reference only and not intended as an endorsement or statement that the information provided by the other party is accurate. We are not compensated for any products or services purchased from these third-party links

Don’t wait until it’s too late! Check out our current plans and get your free quote.

Home Warranty

You have signed the papers, picked up the keys, and stepped into your brand-new home. Everything feels just right until trouble sneaks in. A new construction home warranty might be..

Household Tips

Buying a home is exciting. But maintaining it afterward? Not so exciting, but ten times more important. Also, smart homeowners know that a regular home maintenance checklist is the best..

Household Tips

One day you might take a shower, and the next you might run the bath. For everyone with a combination shower and bathtub, this is a choice we don’t expect..