No matter how much effort you put into maintaining your home, the reality is that sooner or later, a key appliance or major system will wear out. When that happens, the choice of how to handle repairs is yours. Many homeowners turn to home warranty benefits as a reliable solution to manage these unexpected expenses caused by normal wear and tear.

In the past, we’ve briefly touched on the benefits while answering the question of whether they’re worth it. However, to be an informed buyer, you should know the exact advantages you get by having a warranty.

But, really quick… what does a home warranty do?

If you’re not sure what it is, that’s totally fine! We all have to start somewhere. (Feel free to move on to the next section if you already know.)

Home warranty is one of those terms people hear during a house purchase, but don’t always fully understand. Simply put, it is a service contract that helps cover the cost of repairing or replacing major systems and appliances. However, coverage applies only to breakdown due to normal wear and tear. Think of it as a backup plan for the things you rely on every day, like your HVAC system, plumbing, electrical systems, refrigerator, oven, or dishwasher.

So how does it actually work?

When there’s an issue, all you need to do is submit a claim. Your home warranty company will connect you with a contractor, cover repair and replacement costs, and manage everything from there. You just need to cover your annual costs and a small fee for each claim on the day of service.

Still, feel like you need a bit more info? Learn what a warranty covers and how it works.

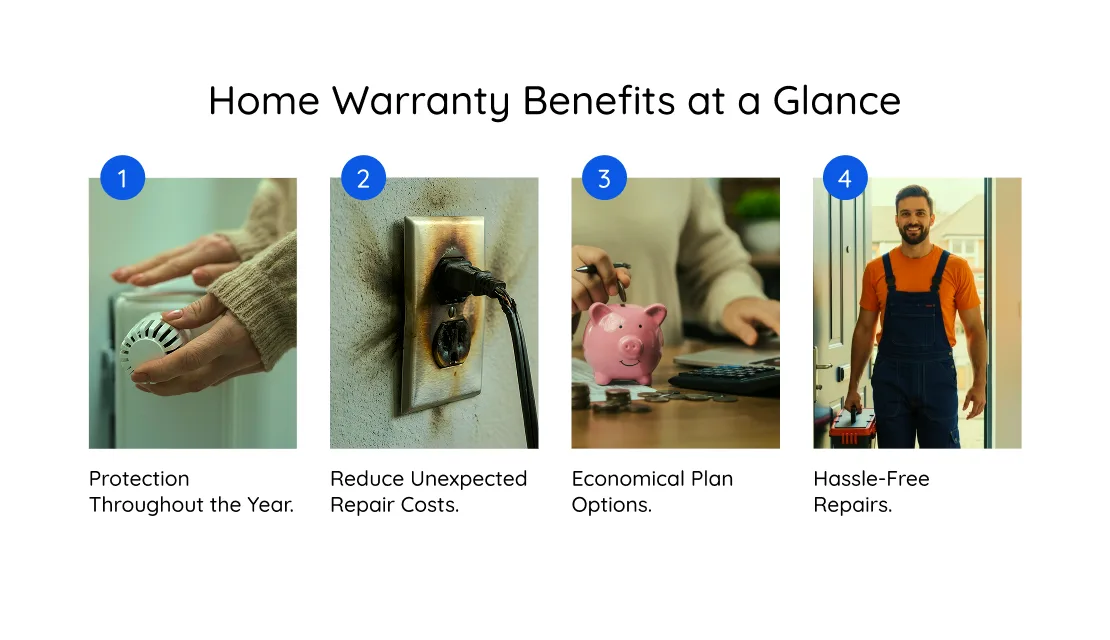

We all know how costly repairs can be, but with a warranty, you can protect yourself from those expensive surprises. Let’s explore how it can make homeownership stress-free.

Most home warranty plans last for one full year, which is 365 days of coverage starting from the effective date of your contract.

What does that really mean for you? It means complete home protection through every season. If your heating system stops working in the middle of winter, you are not left worrying or searching for technicians. If your air conditioner gives up during a summer heatwave, you are not facing the full repair bill alone.

With an active plan, you don’t have to stress about when something might break down. No matter the season, you have a plan in place.

As mentioned earlier, your warranty covers the cost of repairing or replacing certain home systems and appliances. In most cases, you are responsible for the annual premium and a service call fee when a technician visits your home.

These examples highlight how quickly repair bills can add up. Compared to those figures, the annual cost of home warranties and a per-visit service fee are often considerably lower. This is especially true when a major system or appliance needs attention.

To learn more, reach us at 800-670-8931 today or click below for a free quote!

Home protection coverage can help manage unexpected repair expenses without requiring a large upfront investment. Instead of paying the full cost of major breakdowns out of pocket, you pay an annual premium and a service fee when repairs are needed.

Since every house is different, many home warranties offer flexible coverage options. You may be able to include protection for additional items as well. This allows you to choose coverage that aligns with your household’s actual needs.

If you’re exploring home warranty benefits, you may find that coverage extends beyond the basics. Below are a few lesser-known items that can be included under certain plans.

We all know how tiresome it can be to find the right technician for any type of appliance or system repair. Comparing reviews, making calls, and waiting for estimates can take more time than the repair itself.

Fortunately, with a warranty in place, you typically gain access to a network of experienced service professionals. Rather than managing the search yourself, you file a claim request, and a technician is assigned for repair. That’s it!

If you already have insurance, you might wonder why you would need a warranty at all. Well, there is, and the answer lies in the type of protection each offers!

Home insurance covers major, unexpected events such as fires, theft, and damage from natural disasters. While these incidents may be rare, they can be extremely costly. That’s also why premiums can be higher in areas prone to flooding or severe weather.

A warranty, on the other hand, focuses on everyday breakdowns, like a refrigerator that stops cooling or plumbing that starts leaking due to normal wear and tear. These are issues homeowners are far more likely to encounter, and a warranty helps manage these routine repairs in a more predictable and affordable way.

Making a smart choice starts with reviewing the details carefully. The right plan should match your home’s needs and give you dependable support when repairs come up.

Evaluate the Cost vs. Benefits

Look at the annual premium and service fees, then compare that with what you might spend on major repairs or replacements out of pocket. Think about the age and condition of your systems and appliances.

Consider Repair Timelines

Service requests usually depend on technician availability and part supplies. That can affect how quickly an issue is resolved. It’s helpful to review the provider’s response times and service process so you know what to expect if something needs attention.

Review Coverage Limits and Exclusions

Most plans include coverage caps and specific exclusions. Taking time to read these details helps prevent misunderstandings later. Make sure the items you rely on most are included and that the coverage limits align with the potential repair costs.

When you break down the numbers and timelines, the benefits of home warranty coverage often become clearer in terms of potential savings.

Now that you know the home warranty benefits, it’s time to purchase one!

To get set up with the perfect plan for you, start with a free quote. Our experts can then help you figure out exactly the right warranty coverage and get your systems and appliances protected ASAP.

It can be worthwhile if your home’s systems and appliances are aging, as major repairs or replacements can be expensive. A service contract helps reduce high out-of-pocket costs by covering eligible breakdowns for an annual premium and service fee.

Most plans exclude pre-existing conditions, cosmetic damage, structural elements, improper maintenance, and damage from natural disasters or pests. Coverage generally applies only to mechanical failures caused by normal wear and tear.

You can usually submit multiple service requests during the contract term for covered items. However, service fees and coverage caps may apply depending on your plan.

Don’t wait until it’s too late! Check out our current plans and get your free quote.

Home Warranty

When you purchase a home warranty, it’s a unique agreement to care for your home’s appliance and system needs. While you can choose which parts of your home are covered..

Real Estate

You’ve done your research, you’ve saved up, and now you’re finally able to consider whether you’re ready to buy a home. Since most people believe they’ll eventually become a homeowner,..

Household Tips

Laundry day gets annoying fast when the dryer won’t behave. If your dryer timer not working the way it should, cycles may stall, run too long, or stop at random...